Know Faster Than The Fed

An Alternative Data Preview of the September FOMC Meeting Key Takeaways Since the June Fed meeting, sentiment around the US economy has changed noticeably. MacroX’s nowcasting of US economic growth has consistently shown an economy growing faster than widely forecasted (see here, here, and here). This optimism over the US economy has now become widespread […]

Nowcasting the Chinese economy: August 2023 update

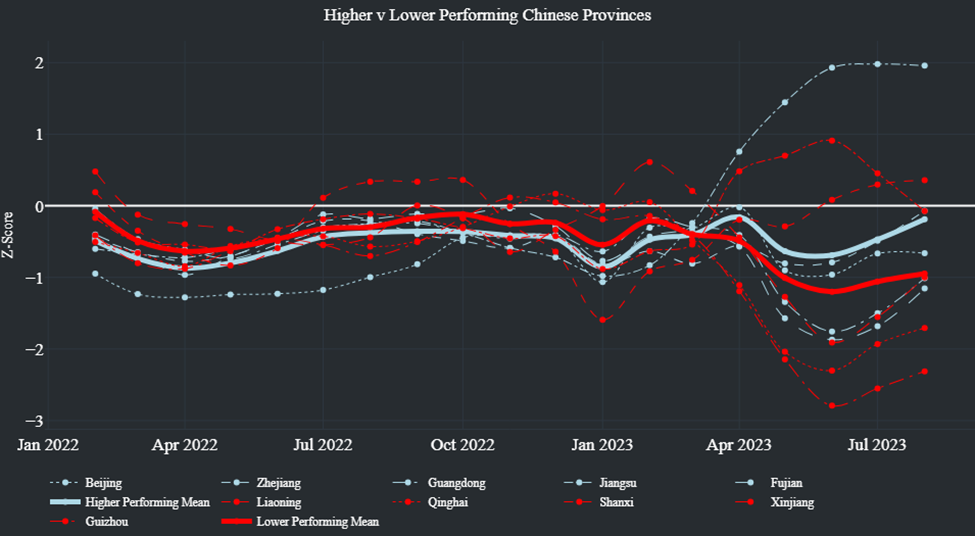

We first published a post on the disappointing Chinese recovery in April. Since then, while the official data have turned lower, MacroX finds that the economic performance is worse than reported. Our alternative data and AI-based measure is in line with the unofficial Le Keqiang index. Below-trend activity in Australia, Brazil, and Taiwan – the main exporters to China provides additional support. In this post, we also discuss the lower response to stimulus of overindebted Chinese cities in less economically diverse and poorer provinces.

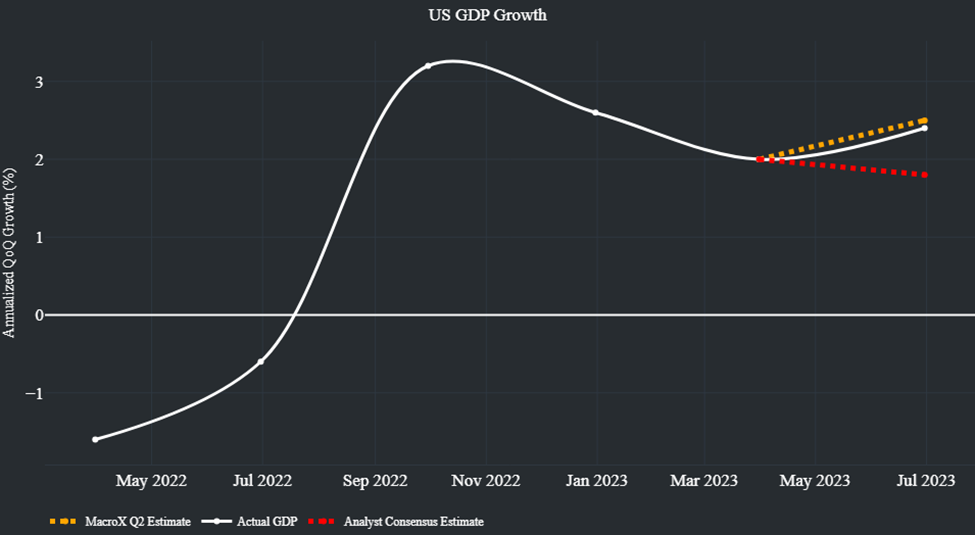

US Q2 GDP Update

Q2 economic growth came in at 2.4%, surprising analysts but in line with MacroX’s Nowcast

Don’t Wait for Godot Recession – Nowcast

Renowned financial journalist John Authers captures the current economic punditry zeitgeist well – “That the US economy is expected to plunge into a recession later this year, is perhaps the most anticipated downturn on record.”

Ukraine’s Economy after the Invasion: An Alternative Data Perspective

Russia’s invasion of Ukraine and the subsequent war has had devastating consequences for the Ukrainian economy…

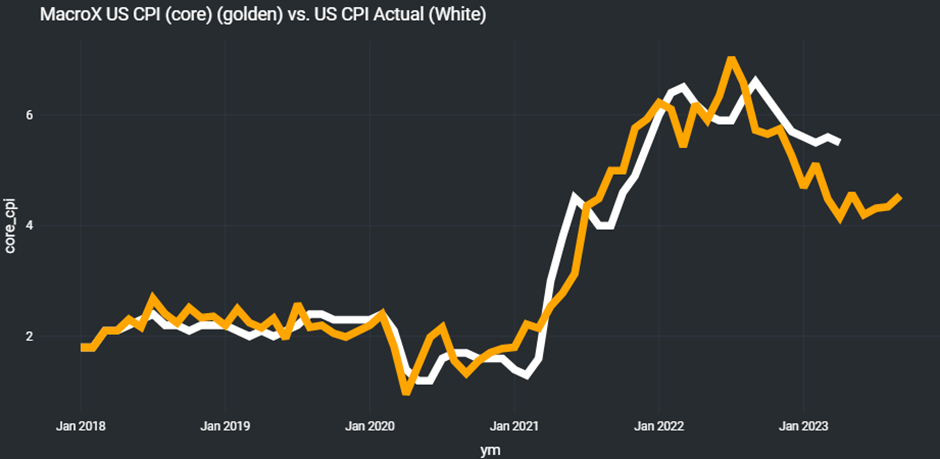

MacroX’s View on May US CPI

MacroX sees core CPI inflation rising 0.43% last month, in line with consensus

MacroX’s Eurozone Update

Consumer price inflation remains uncomfortably high in the Eurozone. The headline rate in April came in at 7% with core inflation also printing close to record highs at 5.6%.

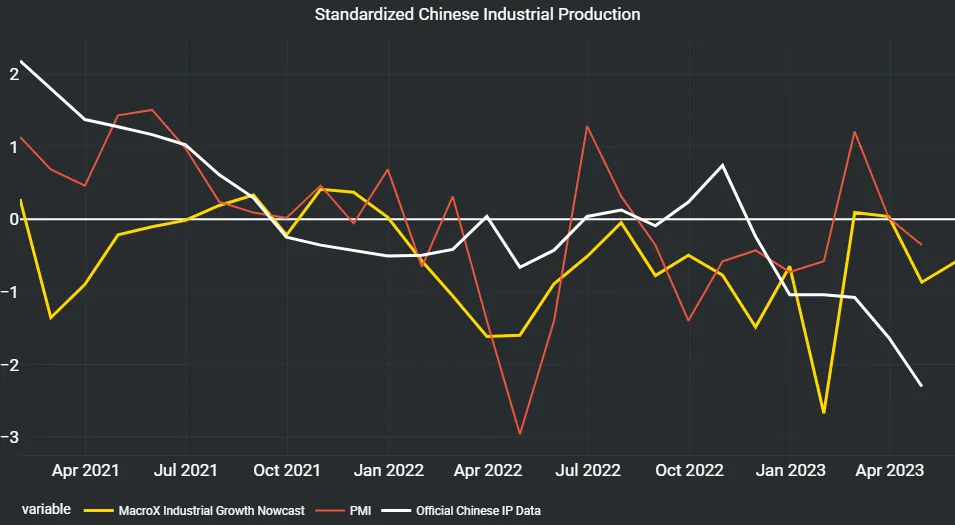

MacroX’s China Update

The weaker Chinese Industrial Production and Caixin PMI for April are both in line with MacroX’s Nowcast of economic activity – in contrast to analysts’ bullish expectations