Key Takeaways

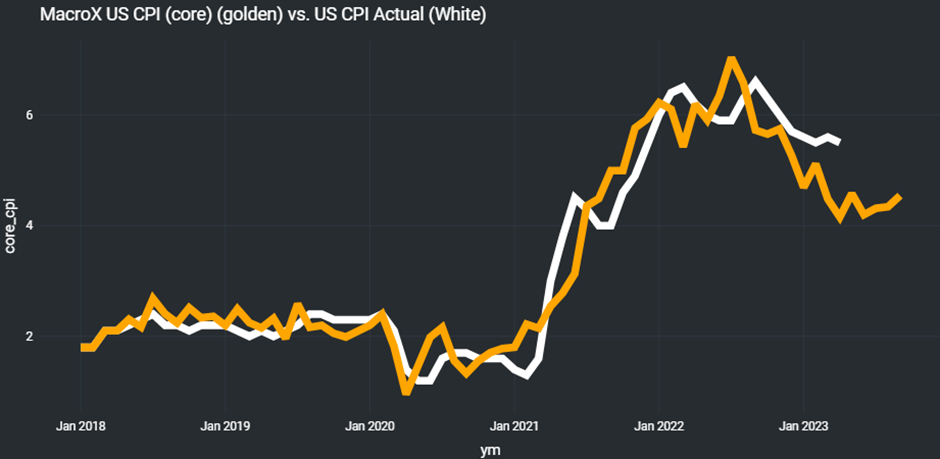

- MacroX sees core CPI inflation rising 0.43% last month, in line with consensus

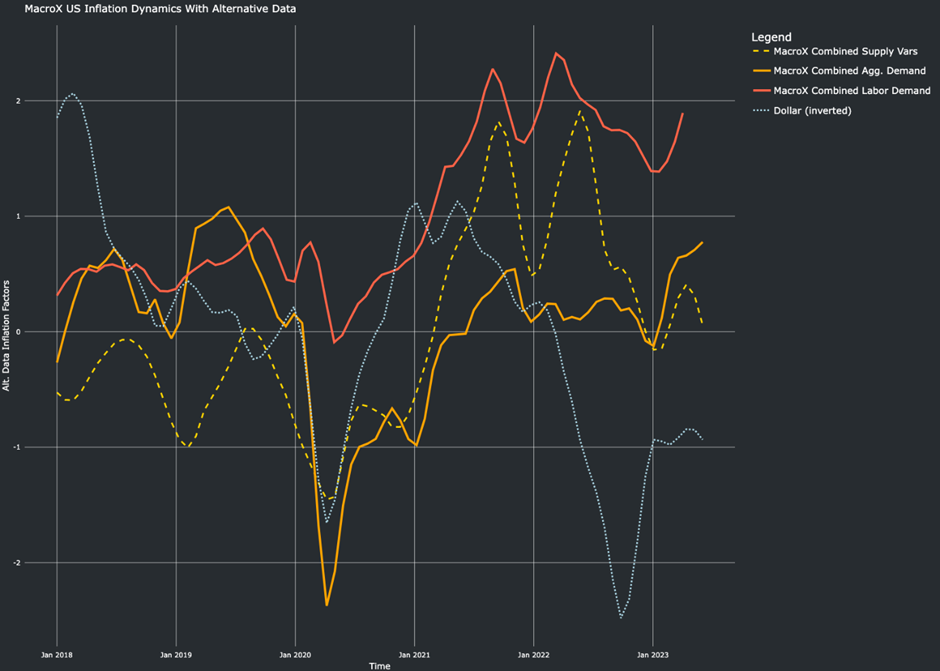

- Our inflation model uses bottom-up alternative data as inputs into a top-down macro framework

- This framework allows us insights into the future path of inflation and we see core inflation remaining sticky above 4% into Q3 2023

- Given the stickiness of inflation and the robustness of US activity, we believe the market is underestimating the probability of future Fed hikes

Introduction

Since our last US inflation post, yields have significantly risen (5y US swaps up >40bps) as markets have become more optimistic about the US economy’s ability to weather the regional banking shock. Observers expect the Fed to keep rates on hold later this week (06/14) but for the Fed’s Summary of Economic Projections to show a more hawkish future path of rates due to the robustness of US economic activity and the stickiness of inflation. The future stickiness of inflation is a key question for market participants and tomorrow’s (06/13) US CPI inflation print is the next data point we get to help answer this question. MacroX sees US core inflation rising 0.43% MoM in May in line with consensus which sees US core CPI rising 0.4% MoM (5.2% annually) and for headline CPI to rise 0.2% MoM (4.1% annually).

How typical Inflation forecasts are calculated

Inflation forecasts are often generated using a bottom-up analysis which tries to model price changes in the underlying categories which make up the inflation index. These bottom-up forecasts have little to say about the macro picture and don’t use an overall macro view to forecast changes in the inflation picture beyond the next data print. Other forecasts are constructed top-down by macro strategists who use traditional data sets which are subject to the usual caveats (lagged, subject to revisions, etc).

MacroX’s innovative inflation model

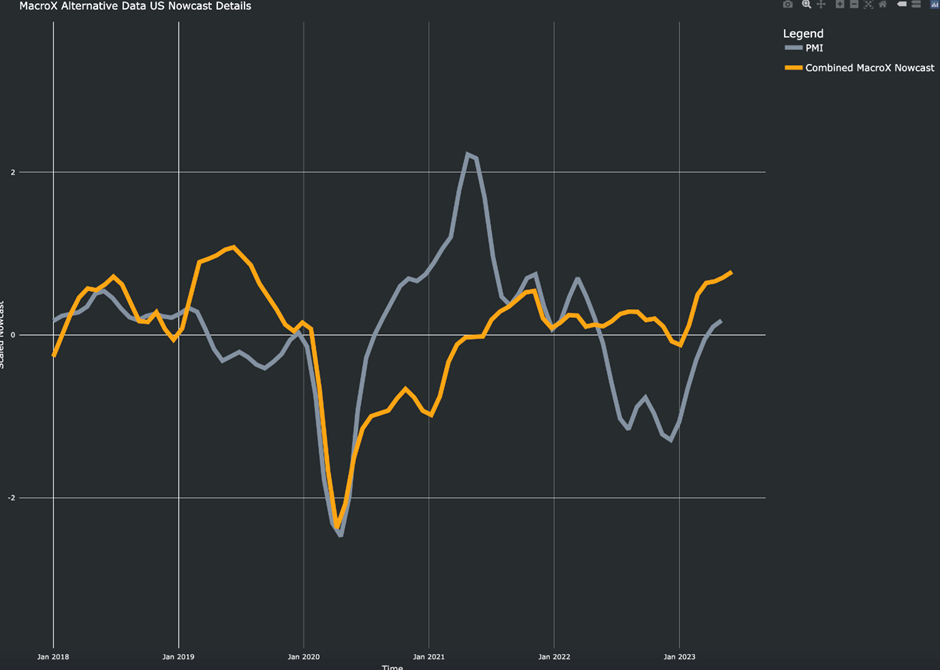

MacroX’s inflation model tries to unify these two approaches by using many new alternative data sources (borrowing from the bottom-up approach) and models their dynamics based on fundamental macro principles (top-down). By synthesizing these two approaches we are able to have a fresh view on the inflation picture. For example, we agree with other analysts that the supply components of the CPI are likely to continue on their downward trajectory tomorrow. However, our alternative-data generated Nowcasts of growth and labor demand show an economy that is hotter than other measures suggest (e.g. the PMI):

Our synthetic approach provides us with insights into the future path of inflation. The economy and labor market’s current hotness means our model has core inflation remaining sticky at over 4% until at least September with month-on-month numbers remaining around 0.4% as well.

The Fed is laser-focused on the labor market and extremely concerned over the impact of wages on inflation. With labor demand and economic activity currently running hot and core inflation consistently remaining over 4% for the next few months, we believe current market pricing (13bps of hikes in the SOFR curve) is likely underestimating the extent to which the Fed may hike in the upcoming months.

Conclusion

MacroX’s inflation model combines alternative data inputs and a top-down macro model to generate inflation insights. Given the stickiness of inflation and with US activity remaining robust in the face of the regional banking shock, we think there is scope for the Fed to hike further than markets currently have priced in.