Key Takeaway:

- The weaker Chinese Industrial Production and Caixin PMI for April are both in line with MacroX’s bearish Nowcast of economic activity – in contrast to analysts’ bullish expectations

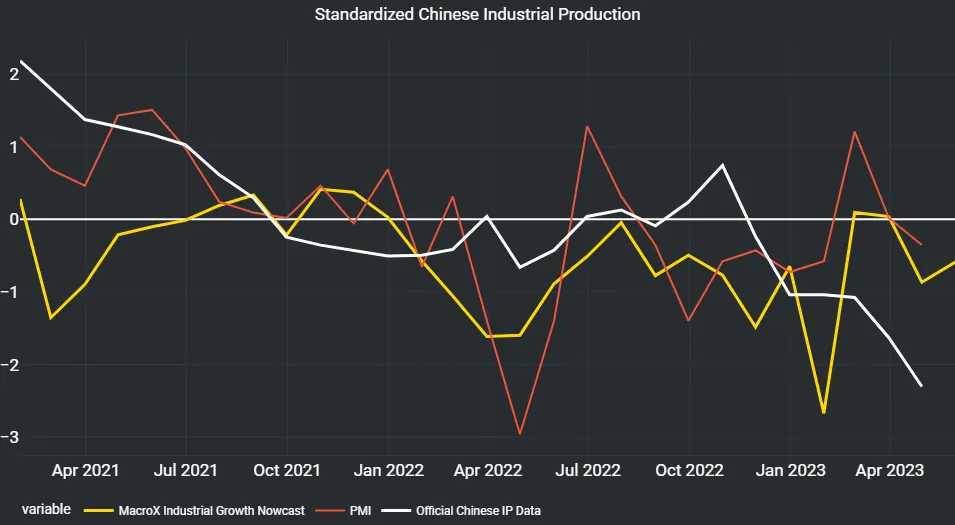

In a previous post, we detailed how our Nowcasts of Chinese growth were disappointing relative to expectations of the acceleration that observers predicted following the lifting of Covid restrictions. Indeed, analysts predicted a 10.9% increase in industrial production in April year-on-year. However, the data surprised to the downside at 5.6% (-0.47% MoM) earlier this week, confounding expectations. This was much more in keeping with our Chinese Nowcast as shown below:

It wasn’t just industrial production data that came in weak; both retail sales and fixed asset investment disappointed relative to expectations. Furthermore, the Caixin Manufacturing PMI for April also dropped to 49.5 from 50 in March. These data releases were all in line with our Chinese Nowcast showing the value of alternative data generated macro insights.

MacroX’s Nowcast for growth in May shows a slight improvement but continues to indicate that no reopening-powered lift off for the Chinese economy is occurring.