Key Takeaways

- The ECB has committed to hiking more due to elevated inflation but growth concerns exist

- MacroX’s Nowcasts show current Eurozone growth as modestly positive but with downward momentum and considerable dispersion

- Real-time data will be crucial in signaling the future direction of monetary policy

Eurozone inflation remains high and the ECB is determined to continue hiking rates

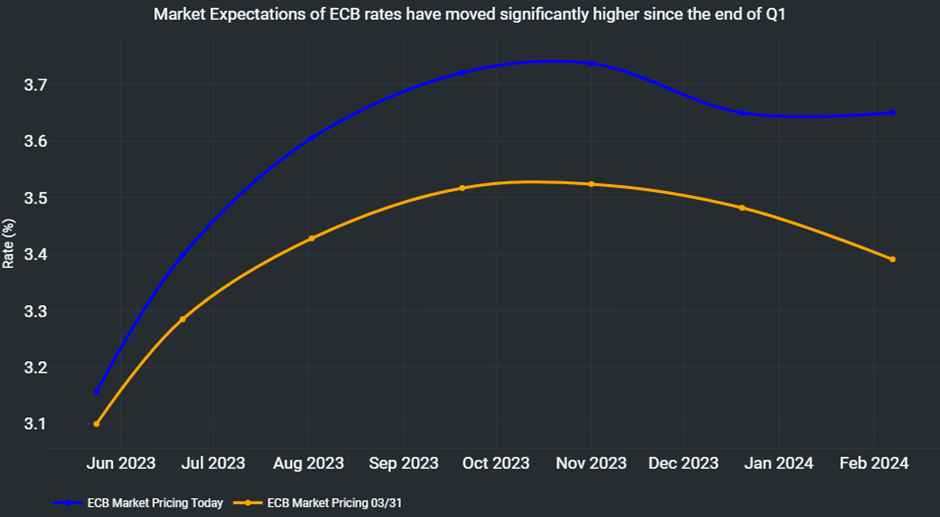

Consumer price inflation remains uncomfortably high in the Eurozone. The headline rate in April came in at 7% with core inflation also printing close to record highs at 5.6%. Given the stickiness of inflation, several ECB officials have emphasized that the central bank’s hiking journey is unfinished. ECB President Lagarde on 05/21 remarked that “We are not done yet…the inflation outlook is too high for too long” and Executive Board Member Schnabel has recently argued that due to the resilience of Euro Area banks, “there is currently no trade-off between price stability and financial stability” i.e. that inflation concerns should dictate monetary policy at this moment in time. Market expectations of the future path of rates have also moved higher, as shown below:

Markets are now expecting a further 60bps of hikes this year with rates peaking at 3.73%, 20bps higher than was expected at the end of Q1 taking the cumulative hiking cycle to 430bps. A recent ECB research paper has stated that this dramatic tightening of policy is estimated to have a “downward impact of 2 percentage points … over the period 2022-25”. Despite this, our previous blog post last month showed that the German economy was proving relatively resilient. However, is this still the case, and what about the other major Eurozone economies?

MacroX’s alternative data Nowcasts show overall Eurozone growth is neutral

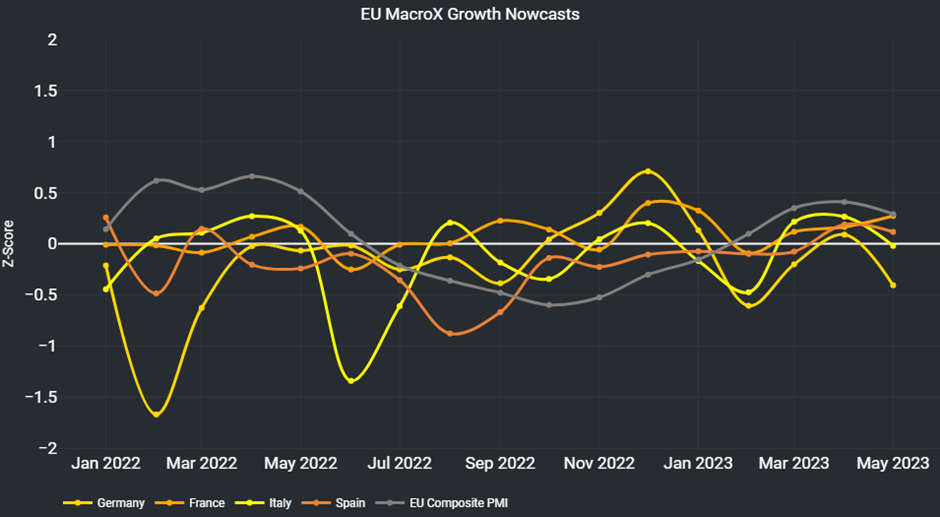

Market observers are aware that official growth data for May will not be released until next month. The flash PMIs for May were released on 05/23 but MacroX’s utilization of alternative data means that its estimates for growth in May are available well in advance of both! Our Nowcasts for the four largest Eurozone economies are shown below:

The chart shows economic growth is broadly neutral across the major Eurozone economies in May. This is in keeping with the Eurozone composite PMI and shows that the ECB’s tightening cycle hasn’t yet resulted in a slowdown of its key economies providing support for the ECB’s decision to prioritize its inflation mandate.

Heterogeneity exists and the trend is troubling

However, the chart has several interesting features which are worth exploring further. One is the heterogeneity across countries. Growth in France seems much more robust than growth in Germany potentially reflecting the German economy’s closer relationship to China (our previous blogs here and here have described how our Nowcasts show growth in China has disappointed this year). Furthermore, the rate of change in growth seems to be trending negative in three of the four economies potentially heralding an upcoming slowdown.

The importance of real-time data

The need for real-time data in the event of a slowdown is self-evident as a change in the fortune of the Eurozone will cause drastic changes in central bank policy and market pricing. MacroX’s real-time nowcasts will be the first to catch any such slowdown and will enable investors to position themselves appropriately before other market participants.