Key Takeaways

- Official Job Openings data (JOLTS) for August, with implications for US growth and inflation surprised to the upside, but is notoriously noisy

- Two respected sources of alternative data for Job Postings tell different stories, and potential revisions and seasonal adjustment issues further complicate the picture

- Combining more TYPES of alternative data – including web search and news confirms the strong labor market and can shed light on what to expect for September data

- Reducing noise or increasing conviction in a positioning view can be as helpful as faster data

US Job Openings for August surprised to the upside earlier this week, with the number of available positions rising to 9.61m from 8.92m in July. Economists had been expecting a decline to 8.8m in August and the positive surprise made markets reassess the strength of US labor demand with stocks falling and bonds selling off. In the months before August, openings had consistently fallen, contributing to observers belief that the labor market was cooling. However, the job openings data series is notoriously choppy given its survey-based method of measurement. Indeed Steven Rattner has already remarked that the openings data “is a noisy data series, so we will need more months to see if this is a blip or a reversal of the recent cooling trend” , and Jonathan Levin at Bloomberg remarks that “JOLTS report is stocking volatility for no good reason”. Given this, can market participants trust the latest Job Openings number and, does it portend a tighter labor market?

What can Job Postings Data Tell Us?

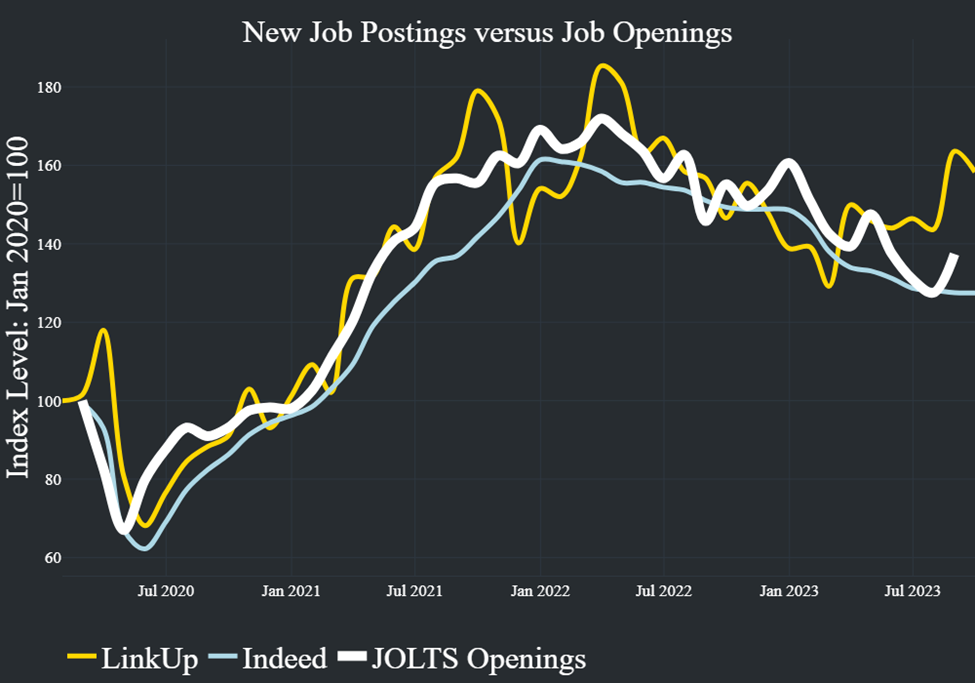

At MacroX, we use two sources of job postings data – Indeed and LinkUp. They both tell diverging stories in August, with LinkUp predicting the rise in the official number while Indeed had postings falling in August, as shown below:

However, both measures show postings fall slightly in September – which will reassure observers worried about a continued tightening of labor market conditions. Given this, we would expect to see the September Job Openings data to moderate.

Seasonal adjustments

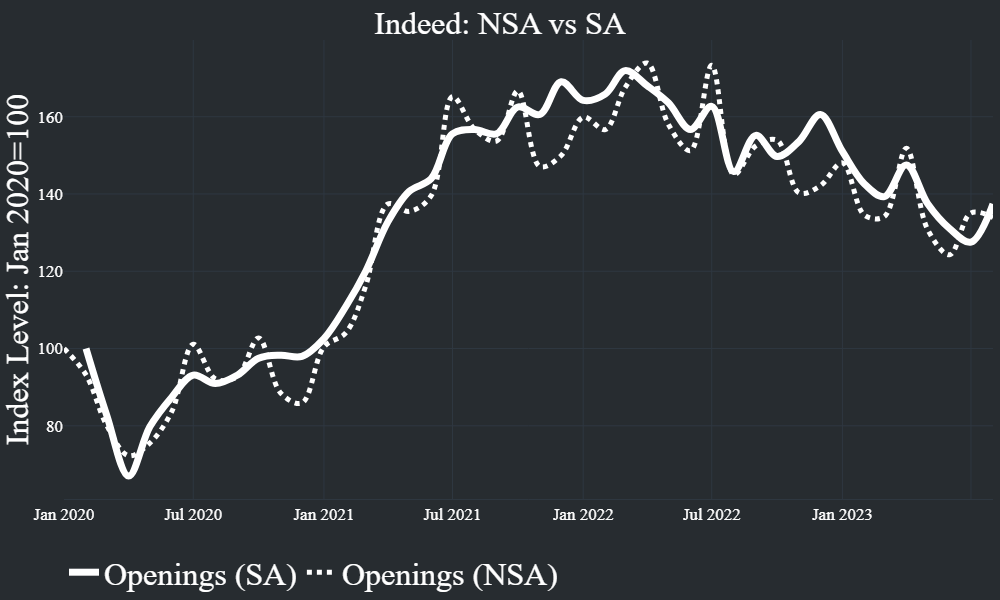

The market is preoccupied with openings increasing from July to August. Interestingly, the non-seasonally-adjusted series actually showed openings ticking down in August from July as shown in the chart below:

What is clear from looking at both the SA and NSA time series is that although postings have ticked up in recent months, they remain some way below their peak.

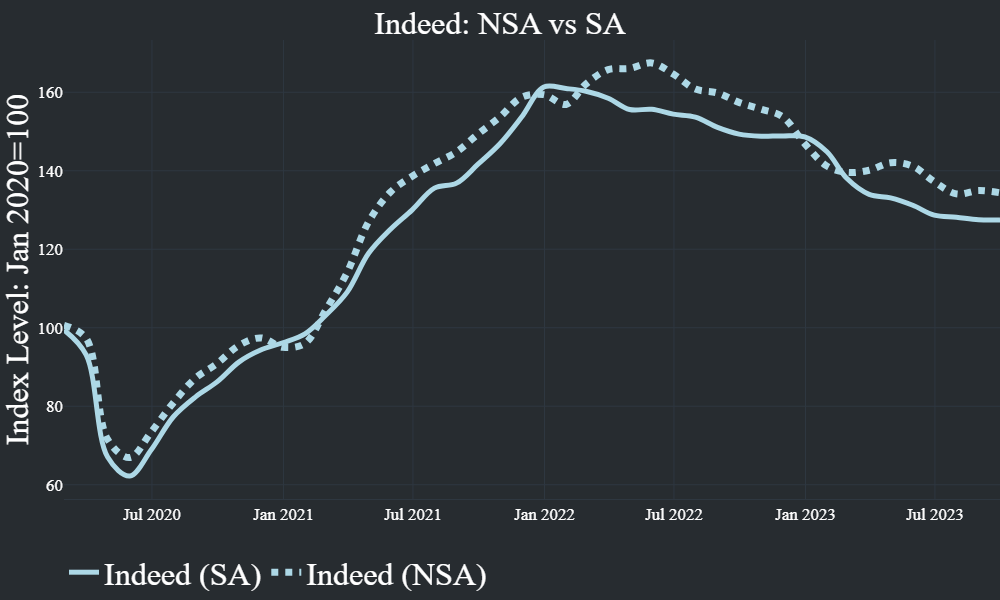

When comparing the seasonally adjusted and non-seasonally adjusted Indeed time series, we see the opposite dynamic taking place. Indeed’s non-seasonally adjusted series actually slightly rose in August but the seasonal adjustment Indeed uses means their “official” series fell.

Evidently being aware of the seasonal adjustments are crucial when reacting to data surprises.

What do other Alternative Data Sources tell us?

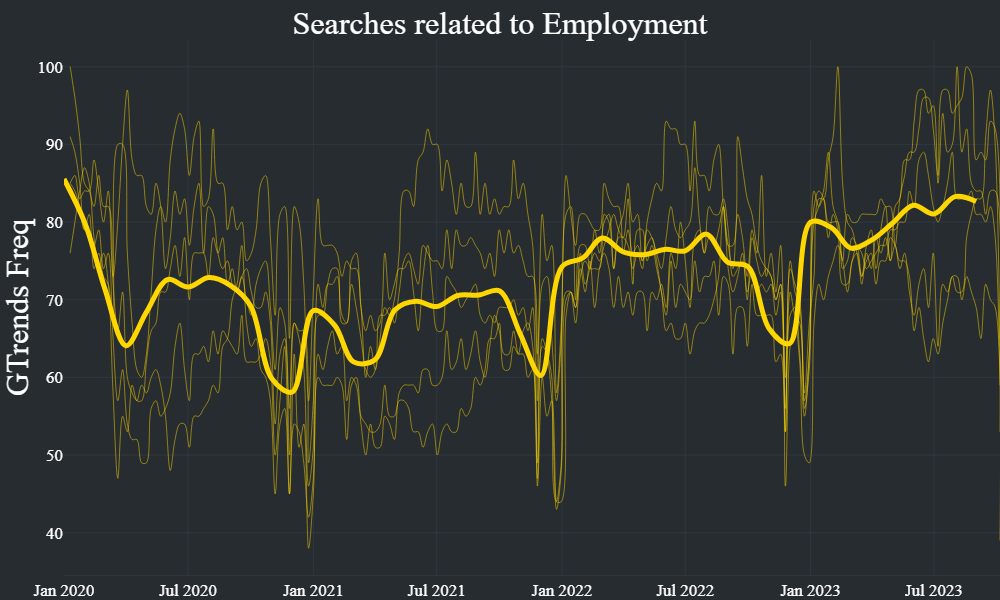

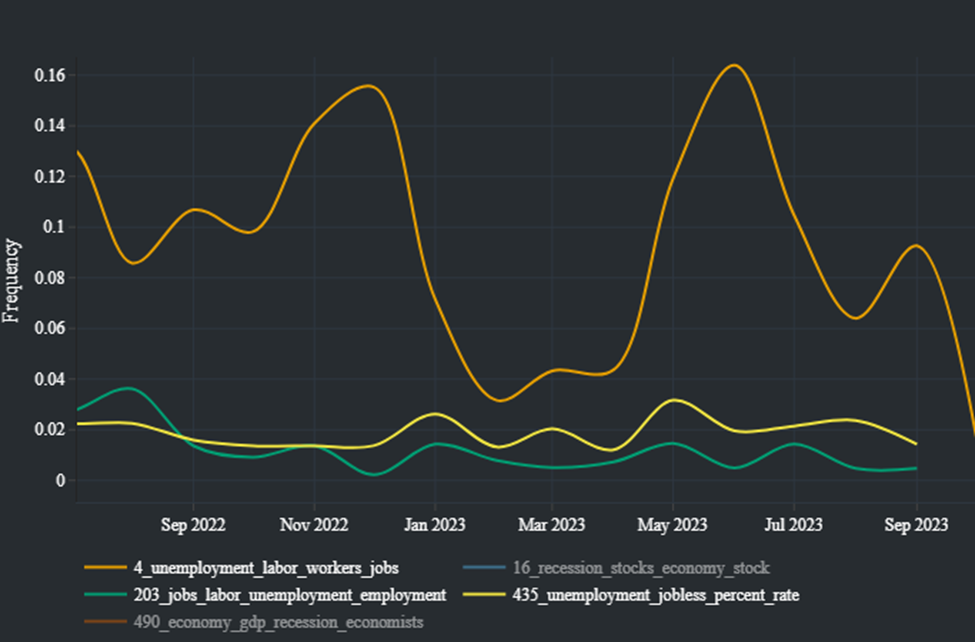

At MacroX we have created a portfolio of keywords related to employment and track how searches relate to them change over time. For example, during March and April 2020, searches related to employment fell dramatically as people grew concerned about their job prospects and their primary concern was unemployment. We can see that searches related to employment pushed up in August but, like the job posting data, fell back in September.

Furthermore, the prevalence of topics related to unemployment in financial news continue to decline from their peak earlier this year, lending credence to a strong labor market.

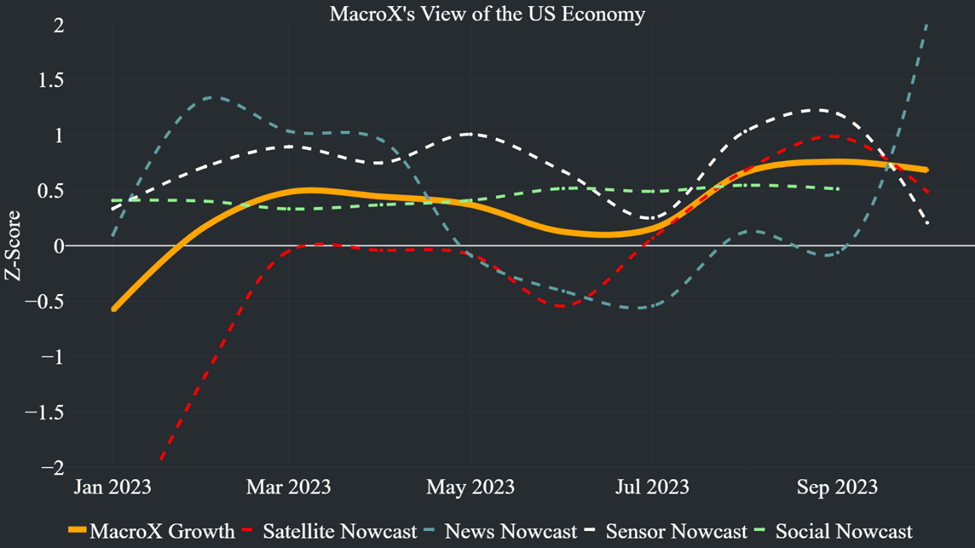

Our measure of US activity also continues to show an economy which is growing robustly (as mentioned in our US deep dive published last month) which will help support the labor market:

Therefore, various alternative data sources all suggest the US labor market is in healthy shape giving us confidence that the tick-up in Job Openings data in August is real but alternative data sources suggest the Openings data for September, which will be published next month, will flatline.

How our Nowcasting Engine works

At MacroX, we use 100+ alternative data signals (from news, satellite, sensor, and social media) coupled with the latest in ML/AI techniques to generate our nowcasts of economic activity. Each component of our nowcast corresponds to economic activity in different ways; our news and social nowcasts (which use the latest LLM technology) can be thought of as a measure of sentiment, our satellite nowcast tracks industrial activity and our sensor nowcast quantify mobility trends. By using a combination of alternative data sources, we create a comprehensive picture of the economy that is real-time and accurate.

If you’re an institutional investor and would like access to our Nowcasting platform, sign up here to join our Waitlist.