Can data dependent pilots manage a “soft landing”?

Key Takeaways:

- MacroX real-time growth nowcasts show developed market growth around trend – in contrast to the more pessimistic ‘soft data’

- Inflation, while trending down, remains uncomfortably high across advanced economies

- Data dependency is the key phrase across central banks engineering a ‘soft landing’ but confronted with sticky inflation

| Country | MacroX Real-Time Growth (Z-Scored) |

MacroX Real-Time Growth Momentum | PMI (Z-Scored) |

Lagged Official Growth – Q2 GDP (annualized) | Inflation | CB Stance | Major Themes |

|---|---|---|---|---|---|---|---|

| United States | 0.52 | 0.20 | -0.40 | 2.1% | Inflation trajectory encouraging, CPI/PCE both around 4% but diverging over next few months? | Mostly Hawkish – 20% chance of hike priced into Nov | Soft Landing – growth higher, inflation trajectory is encouraging |

| Germany | 0.09 | -0.05 | -0.79 | 0% | Large drop in annual yoy CPI in September to 4.5% | Mostly Hawkish – ECB raised rates 25bps in Sep but markets expect no further hikes | Terms of trade shock and China weakness weighing on economy |

| France | 0.23 | -0.04 | -0.79 | 2% | Headline/Core inflation around 5% | Mostly Hawkish – ECB raised rates 25bps in Sep but markets expect no further hikes | Growth robust |

| Italy | -0.07 | 0.06 | -0.16 | -1.6% | Headline/Core inflation trending lower, both measures around 5% | Mostly Hawkish – ECB raised rates 25bps in Sep but markets expect no further hikes | Economy unexpectedly shrunk in Q2, populist government is a risk to economic performance |

| Spain | -0.13 | -0.14 | -0.03 | 2% | Core inflation sticky around 6% | Mostly Hawkish – ECB raised rates 25bps in Sep but markets expect no further hikes | Tourism supportive to Growth |

| United Kingdom | 0.24 | 0.29 | -0.43 | 0.8% | August inflation surprised to downside – both core and headline still over 6% | Mostly Hawkish – BoE unexpectedly kept rates on hold in Sep, c. 50% chance of a hike priced into Nov meeting | Inflation unexpectedly dropped in August, BoE keeps rates on hold |

| Australia | -0.03 | 0.06 | -0.38 | 1.6% | CPI accelerated in August to 5.2% but core CPI eased to 5.5% | Mostly Hawkish – RBA on hold but high Sep CPI print means 40% chance of a hike priced into Nov | Concerns over consequences of Chinese slowdown |

| New Zealand | 0.06 | -0.05 | -0.78 | 3.6% | Core inflation running at ~7% | Neutral – RBNZ on hold | Economy recovered in Q2 after technical recession |

Table 1: The MacroX State of Play across Developed Nations: Our activity nowcasts are much more bullish on growth across the world than the ‘soft data’

MacroX Real-Time Growth corresponds to the 3m average of our activity nowcast. MacroX Real-Time Growth Momentum corresponds to the 3m change in the 3m average of our activity nowcast (i.e. the average of activity in Sep, Aug, and July minus the average of activity in June, May, and April).

USA

Our nowcast of US growth shows economic activity meaningfully accelerating this quarter (in line with other nowcasts like GDPNow and the Bloomberg nowcast). This acceleration, coupled with the fall in inflation has raised hopes that the fabled ‘soft landing’ can be achieved. The consistently positive economic data over the last few months has resulted in yields moving higher with the 10y reaching its highest level since 2007. The Fed has raised their projections for growth in 2023 and 2024 (as we expected), while revising lower their projections for inflation and unemployment.

Looking forward, the Fed has kept open the prospect of one final hike at its next meeting in November. Upcoming inflation data will be key to whether this hike takes place. If the Fed sees continued progress of inflation towards its target, a further hike becomes harder to justify. Headline CPI in August, annoyingly for the Fed, came in higher than expected (3.7% v 3.6% expected). However, core CPI (3.9% v 3.9% expected) and the Fed’s preferred measure of inflation, the PCE (3.5% v 3.5% expected), were much more encouraging. Due to their differing methodologies, CPI seems to have more upside risk over the next few months due to a reversion in airfares CPI (which pushed up the August report) and the health insurance index component of CPI updating in October. But these noisy upward pressures will not affect the PCE – hence the wedge between the two measures could increase. Therefore, the Fed’s preferred measure of inflation (PCE) could progress closer to its target while the more well-known measure (CPI) could indicate a reacceleration, complicating the Fed’s communication of its policy.

Eurozone

Our nowcasts of the German and French economies show both growing slightly above trend in Q3 while This strength is in sharp contrast to the latest Composite PMIs released in both countries. The Italian and Spanish economies are growing slightly below trend, indeed the Spanish economy decelerated in Q3 having grown at 0.5% QoQ in Q2.

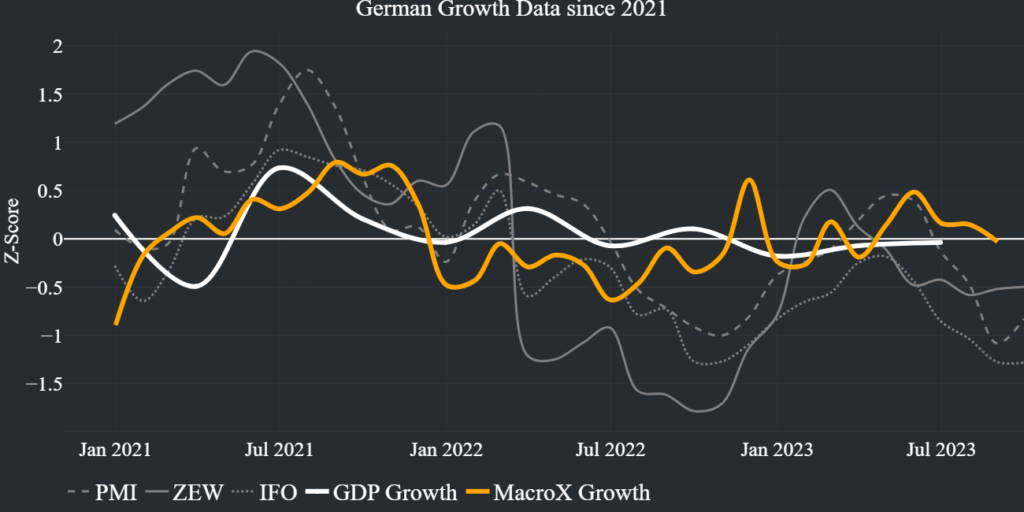

A theme of the last 12 months has been the relative weakness of survey-based measures of activity compared to the official data. An example of this can be seen below where we contrast our nowcast, the official growth figures, and three different examples of ‘soft data’ that are used by market participants. The ZEW, PMI, and IFO are all respected surveys of German activity and we can see that all three surveys have turned drastically lower in Q3 2023. This follows an extended period (since 2022) of the survey data being much more pessimistic about the economy than would eventually be borne out by the hard data. MacroX’s measure of activity, on the other hand, has tracked much closer to the hard data since 2022 and we see no major downturn in activity in Q3.

Inflation across the major Eurozone economies remains uncomfortably high with core inflation at 5% or higher across most countries. However, the ECB’s tightening regime and the terms of trade shock from higher energy costs have weighed on growth constraining the ECB’s ability to continue to raise rates. Despite the ECB raising rates this month, it seemed to signal that rates may have peaked, and markets seem to agree with just over a 10% chance of a further hike priced into the ESTR curve. Again, inflation dynamics over the next few months will be key.

Rest of the World

Our nowcast of British economic activity shows the economy accelerated this quarter. In other good news, August CPI meaningfully surprised to the downside on both the headline and core measures. This was a big enough miss for the BoE to keep rates on hold in September – although the 5-4 vote indicates how contentious this decision was. Despite this hold, the market still thinks there is a strong chance (~50%) that the BoE will hike again this year – again data will be crucial to whether the BoE hikes any further.

Our nowcast of Australian economic activity shows growth slightly below trend and there are concerns over the future growth of the Australian economy due to its dependence on the Chinese economy which is currently stalling.

Data Dependence

With inflation on an encouraging trajectory, central banks feel their aggressive tightening so far this cycle has given them room to see how the data unfolds. For example, Chairman Powell in his Jackson Hole speech remarked that the Fed “will assess our progress based on the totality of the data and the evolving outlook”. With central banks data dependent, access to real-time data becomes ever more crucial.

How our Nowcasting Engine work

At MacroX, we use 100+ alternative data signals (from news, satellite, sensor, and social media) coupled with the latest in ML/AI techniques to generate our nowcasts of economic activity. Each component of our nowcast corresponds to economic activity in different ways; our news and social nowcasts (which use the latest LLM technology) can be thought of as a measure of sentiment, our satellite nowcast tracks industrial activity and our sensor nowcast quantify mobility trends. By using a combination of alternative data sources, we create a comprehensive picture of the economy that is real-time and accurate.

If you’re an institutional investor and would like access to our Nowcasting platform, sign up here to join our Waitlist.