Key Takeaways

- As the world prepares for President Trump’s inauguration, MacroX’s tracks the effect on people, media, traders, and CEOs across the world

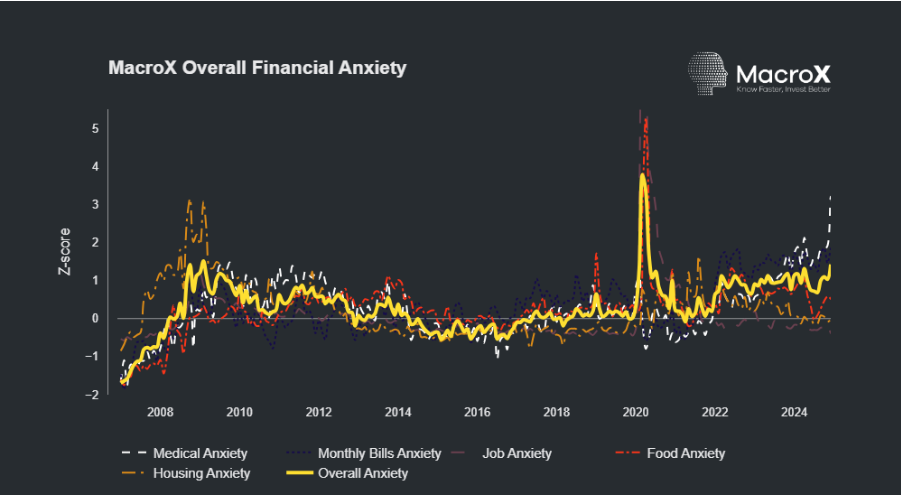

- For US citizens, the Overall Financial Anxiety – not captured in average economic numbers that are good – is high and close to 2008 crisis levels, and currently led by concerns about affording medical care and paying monthly bills.

- This rise of “how to afford my life” question may have played a role in this election and addressing it via tax cuts and/or Fed lowering rates will remain crucial to maintaining the political base.

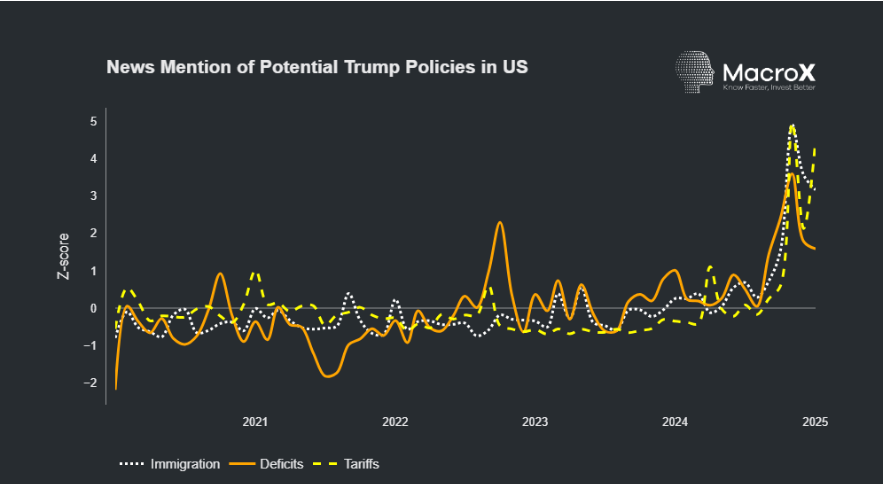

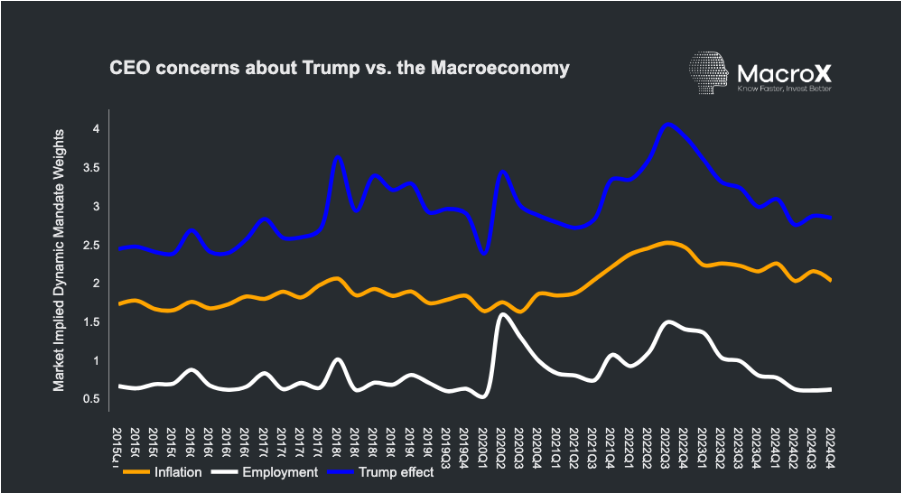

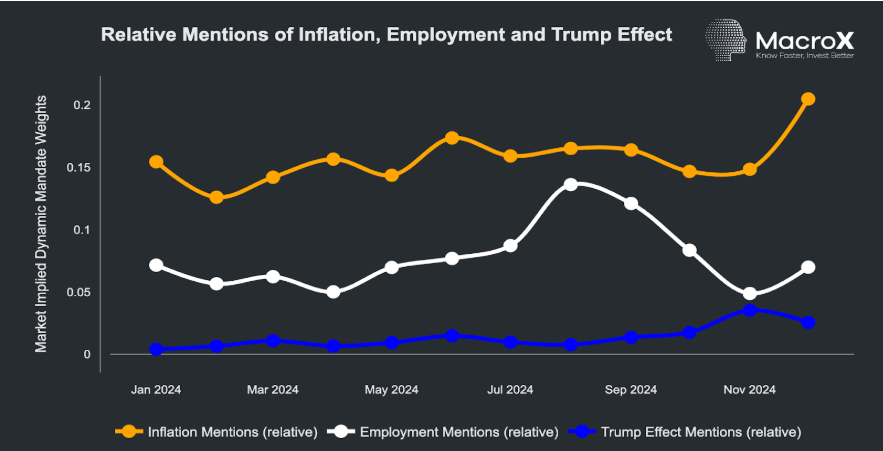

- The overall Trump effect around three major policy pillars – tariffs, immigration, and deficits hit a peak of interest and concern in late November and early December but has since declined with news media being most concerned, CEOs not as concerned yet as they were in 2016-2020, and top traders certainly concerned about Trump but much more worried about the Fed.

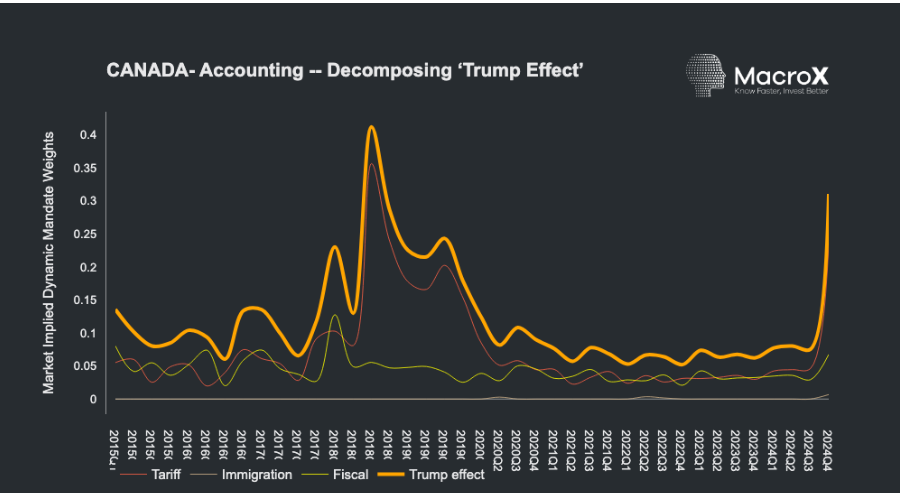

- Externally – Canada CEOs are the most worried about Tariffs even as the same issues of affordability and immigration rise more generally

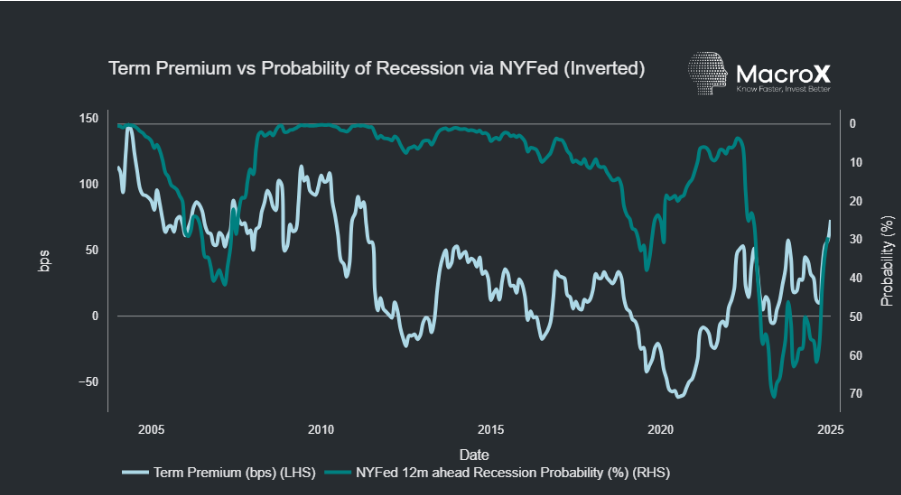

- Finally, much can be attributed to president Trump but the 30-50 bps increase in term premium – a part of the 100 bp 10Y sell-off from September might have more to do with recession is being priced out with robust growth and rising inflation concerns and less with Trump’s policy uncertainty

- This will be an extremely “data-dependent” year with the “second moment” or uncertainty playing a large role in the markets and we think alternative data will be crucial for a nimble response.